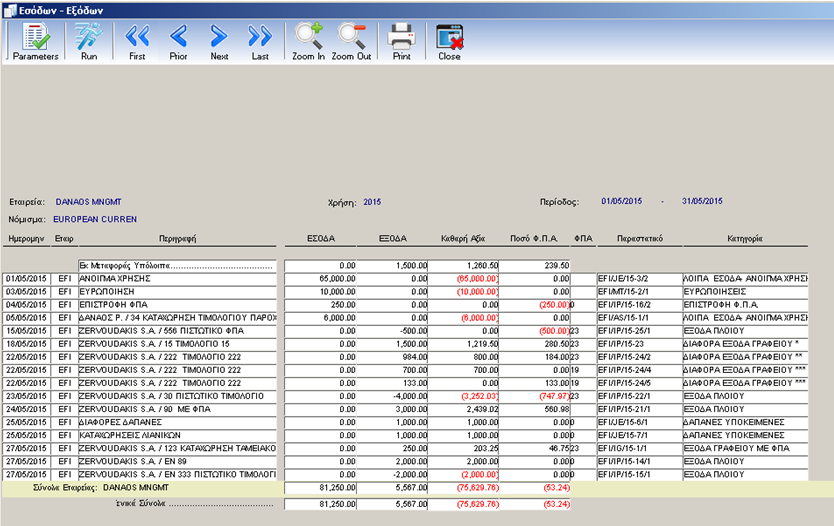

Income and Expenses module presents company financial statements according to Greek General Chart of Accounts, (2nd Category Books). Taxable companies who keep category books and file VAT returns based on the type of their business entity (Ltd-SA) leverage on the automated functionalities of this module in order to create all required financial statements and reports based on the Greek Law Requirements. Income and Expenses Module monitors and ensures compliance with the Code of Tax Reporting of Transactions (KFAS) and all relevant provisions, circulars, guidance or Ministerial Decisions that have been issued in relation to the Code of Books and Records (CBR).

Greek Supplement (3rd Category Books)

Greek Supplement module presents company financial statements according to Greek General Chart of Accounts, (3rd Category Books). Taxable companies who keep category books and file VAT returns based on the type of their business entity (Ltd-SA) leverage on the automated functionalities of this module in order to create all required financial statements and reports based on the Greek Law Requirements. Income and Expenses Module monitors and ensures compliance with the Code of Tax Reporting of Transactions (KFAS) and all relevant provisions, circulars, guidance or Ministerial Decisions that have been issued in relation to the Code of Books and Records (CBR).